India with oodles of populace and that too populacewith diversity in culture and employment factors! Still, the Real Estate sector one of the biggest hands in boosting up the Indian Economy. Ithas grasped revolution after few initiatives taken by the new government due to which big transparency has come in this sector, which has acted as a big hope for the investors. This sector is likely to get a regulator which has been mostly responsible for its opaque practices and the generation of black money with illegal dealings. Two major steps which has affected this sector are RERA and Demonetization.

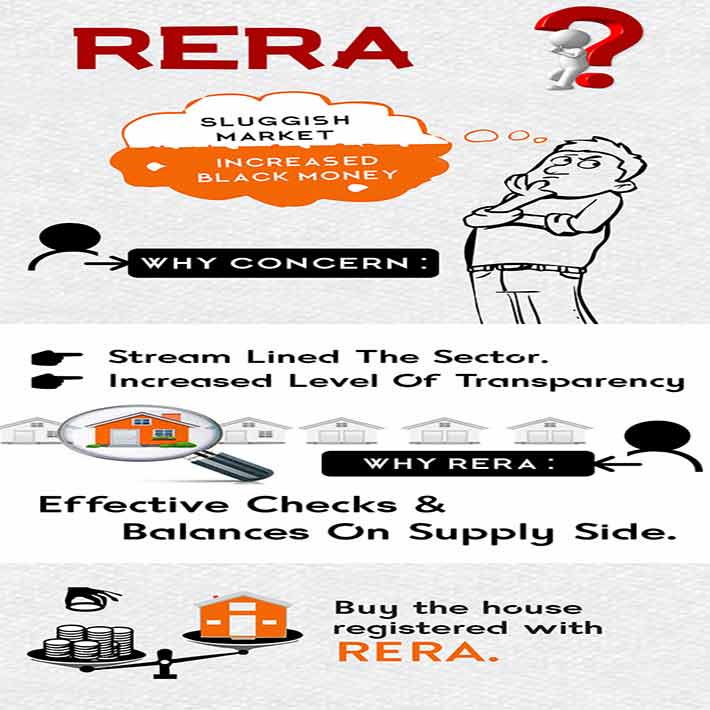

In 2013, a groundbreaking initiative was introduced in RajyaSabha and after long, culminating process, extensive consultations this bill received an acquiescence in 2016. The Real Estate Regulatory Bill has tabled in Parliament,which basically seeks for accountability and transparency in real estate sector.

• The brilliant RERA act of regulation and promotion of the real estate sector and to safeguard sale of any residential property or a sale of real estate project, in a well-organized and clear manner and also to protect the customer’s interests in this sector and to establish an arbitrating mechanism for speedy dispute.

• Transparency in this sector has not been satisfactory from last many years, from now onwards the act has fixed that area of more than 500 Sq. m or eight apartments will be registered with RERA. The Builders now have to disclose all the information regarding to project, no info will be hidden anymore increasing the transparency. Now the buyers will be having affirmed data where they can take their decision freely without any doubt.

• The other important aspects which provide success to the bill are the uniform regulatory milieu, to protect customer interests, help speedy judgment of clashes and ensure the much awaited growth which has been waited by all ambitious home buyers. The bill gives a bright hope for all the investors.

• This has also ensured the buyers that if in case there will be a delay, the buyer can claim a refund with interest and compensation. To a large extent accountability has been ensured, frauds and delays have been reduced and it has empowered buyers.

It was a welcome move to empower the affirm decision in this zone.

Another important, gigantic step taken by P.M NarendraModi has brought a sea change overnight. The higher currency demonetization has shaken up the gauge roots of black money. This surprising announcement has come up as a big challenge for Real Estate sector.

Heavy deflation of the people who earned money through illegal means would be afraid now to declare the money, as now it will be prosecuted by the Income Tax Department on the lawfulness of their income. Nonetheless, the bold and efficient move.

Foremostshakes witnessed:

• There has been an undeniable impact on real estate which has been witnessing high involvement of black money from the last few years and the cash transactions.

• People were not able to turn up their dream into reality because of the unaffordable real estate prices, which constrain them to stay in rented houses, but this step will cool down the real estate market by caching down the black money.

• The pressure on rate structure will be reduced by the reductionin EMI’s which can be decreased by 25- 30% boosting up the activity in the primary market.

• Falling interest rates will induce momentum in the market. So, there is every possibility of resale property prices falling.

• Decision has impacted real estate sales, especially resale because now the deals are transparent in the resale units and new launches. The price gap has narrowed.

• Major impact has been seen on the ultra- luxurious and high end projects that basically involved cash payments and illegal banking. The big transactions have been stopped by banks because the transacting amount have been reduced and the cash transactions have been cancelled.

• The buyer has been benefited by the registration fees levied by the State Govt. is 5-6% of transaction to save the money by decreasing the registration value. Now they are rid of bulky cash.

The most necessary exercises that were needed to bring a tremendous shake up in the long lasting ruthless Indian Real Estate market.

Once the rates come down and RERA come into force, together will increase the end user activity and has made the real estate market transparent with the expected rise in Indian Economy. Experts are saying to follow up the steps firmed by the government to ensure that black and white cycle doesn’t repeat itself. These steps will get major changes and their effects can be seen in Indian Real Estate 2017.